How to Transfer Money From Paytm to Bank Accountĭisclosure: Paytm's parent company One97 is an investor in NDTV's Gadgets 360.

The amount is settled at midnight every day Paytm says it will not levy any settlement charges.

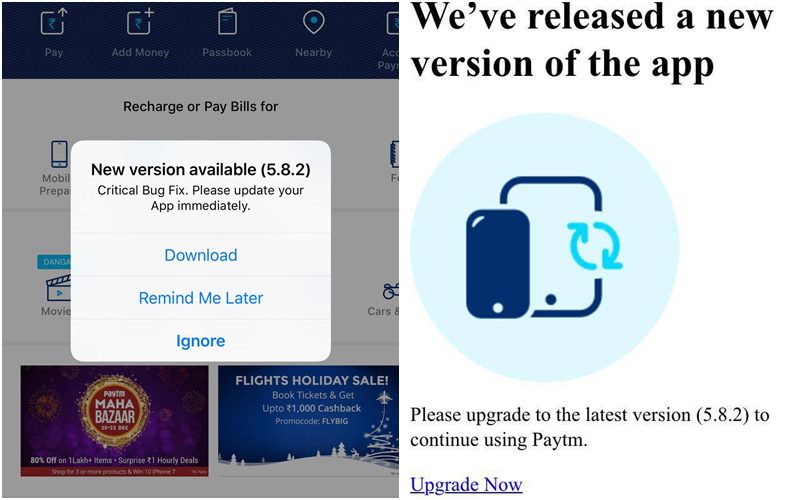

20,000 if the amount crosses this figure, it will be processed directly to the merchant’s bank account. The Paytm Wallet balance of self-declared merchants should not exceed Rs. On the merchant side, self-declared (non-KYC) merchants can now accept payments of up to Rs. Paytm Gets RBI Approval to Launch Payments Bank “This huge base of active Paytm users is an active community that encourages conversations around Paytm’s diverse use-cases,” the company said in a press release. Paytm has also launched a new feature called Paytm Community Forums to help users get their queries addressed by others on the forum the Community Forum feature is integrated in the Paytm app. In order to do this, they need to tap on the Scan Paytm QR from Gallery option on the upper-right corner of the screen in order to scan the QR codes they received in emails or WhatsApp. The Paytm app also has a new mode of payment with the new update: users can now scan the recipient’s QR codes from their device’s image gallery to transfer money. Paytm Integrates UPI Payments System for Wallet Recharge The users can view all the Top Ups done as he transacts and can use his Debit/Credit Card or Net Banking or wallet (Paytm) to pay online for an instant. With this Paytm update, users can now put their fingerprint as their password. The process of adding money on the Paytm app now happens on a single screen, which the company claims translates to quicker load times and faster user experience. According to Paytm, the update makes the app three times faster even on low-end smartphones and slow networks. Digital payments brand Paytm has updated its app to introduce new features that make adding and paying money on its app easier, and has raised the maximum amount that merchants can accept in one go to their bank accounts to Rs.

0 kommentar(er)

0 kommentar(er)